The Market Context

Retail trading has undergone a significant evolution over the past decade, driven by the proliferation of algorithmic strategies and mobile-first platforms. Market participants now demand not only access to real-time data but also assurance that execution pathways are predictable and measurable. Amidst this transformation, transparency in order routing, liquidity sourcing, and fee structures has become a central differentiator, influencing both short-term performance and long-term trust.

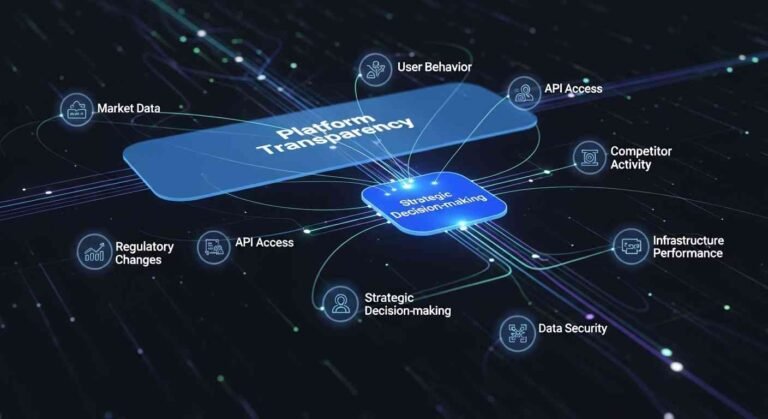

While traditional broker models emphasized brand recognition and marketing visibility, modern traders increasingly prioritize quantifiable execution quality. The integration of institutional-grade technology into retail offerings has redefined expectations, particularly for platforms that manage large volumes of micro-orders. Platforms that maintain transparent reporting and system analytics create an environment where traders can optimize strategies rather than react to opaque mechanisms.

Regulatory Infrastructure

Licensing, fund segregation, and compliance protocols form the backbone of platform credibility. Retail traders often overlook the operational complexity behind regulatory adherence, yet these systems directly affect capital security and dispute resolution. Properly regulated entities implement real-time audits and maintain segregated accounts, ensuring client funds remain insulated from operational risks and systemic failures.

Beyond standard licensing, some platforms adopt advanced compliance frameworks, including periodic stress tests and automated reporting for anomalous trading activity. These measures provide an added layer of transparency, revealing potential liquidity bottlenecks and execution risks before they materially affect traders. The depth of regulatory infrastructure therefore correlates strongly with perceived and actual platform reliability.

The Latency Equation

Latency remains one of the most critical determinants of execution efficiency in digital trading. Even millisecond delays can translate into significant slippage, especially during high-volatility periods. Platforms that expose latency metrics and provide historical execution data allow traders to assess risk-adjusted costs with greater precision.

Market makers employ sophisticated routing algorithms to minimize the impact of latency across multiple liquidity pools. By disclosing execution statistics, including average fill times and deviation from quoted spreads, platforms not only comply with best practice standards but also empower traders to calibrate algorithmic strategies effectively. Transparency in this context functions as both a risk control mechanism and a strategic performance lever.

“Institutional-grade execution is no longer exclusive to Wall Street; platforms like Pocket Option are bridging the gap for retail traders through low-latency aggregation.”

User Experience UX Protocols

Charting functionality, mobile responsiveness, and interface intuitiveness directly influence trade decision speed and accuracy. A transparent UX allows traders to cross-reference execution outcomes with visual indicators such as order book depth and historical volatility overlays. Platforms that embed analytical tools within the user interface reduce cognitive load and improve decision confidence.

Beyond surface-level aesthetics, UX transparency includes exposing API connectivity status, latency variations, and order confirmation timestamps. Traders leveraging these indicators can optimize entry and exit points, particularly when executing high-frequency or algorithmically-driven strategies. This approach shifts platform evaluation from subjective perception to measurable performance criteria.

Risk Management Features

Advanced risk mitigation protocols are essential for maintaining platform integrity under stress conditions. Features such as negative balance protection, customizable stop-loss limits, and real-time margin alerts form a foundational framework for safeguarding capital. Platforms that openly communicate the mechanics of these tools enhance trader understanding and reduce the likelihood of unexpected losses.

Transparency in risk management extends beyond feature disclosure to include system-level resilience, such as automated liquidity fallback and event-driven exposure limits. Traders benefit from visibility into how stop-losses are processed during periods of high volatility, ensuring predictable behavior. Ultimately, transparent risk management aligns platform incentives with trader outcomes, mitigating moral hazard.

Latency vs Execution Cost Analysis

Quantifying the relationship between latency and trading costs reveals the hidden inefficiencies within execution pipelines. Platforms that provide detailed statistical models of slippage, spread variability, and fill probability enable traders to conduct rigorous scenario analysis. By understanding the incremental cost of latency, market participants can make informed decisions on order sizing, timing, and routing strategy.

Visualization tools that graph latency against execution costs offer immediate insight into operational performance under different market conditions. Transparent disclosure of these metrics fosters accountability and creates a competitive environment where platforms are incentivized to optimize technology stacks. In effect, latency transparency becomes a strategic lever, impacting both short-term trade profitability and long-term platform credibility.

Future Outlook

Looking toward 2026, the integration of AI-driven order routing and automated liquidity management will redefine platform transparency standards. Predictive execution models, combined with real-time risk analytics, are expected to become the norm rather than a differentiator. Traders will increasingly evaluate platforms based on their ability to deliver actionable insights rather than marketing promises.

Emerging automation technologies promise to reduce operational friction, but they also introduce new transparency demands around algorithmic decision-making. Platforms that openly communicate AI logic, model assumptions, and failure modes will gain strategic advantage. Ultimately, the convergence of technology, regulation, and data-driven UX will dictate which platforms achieve sustained market relevance.